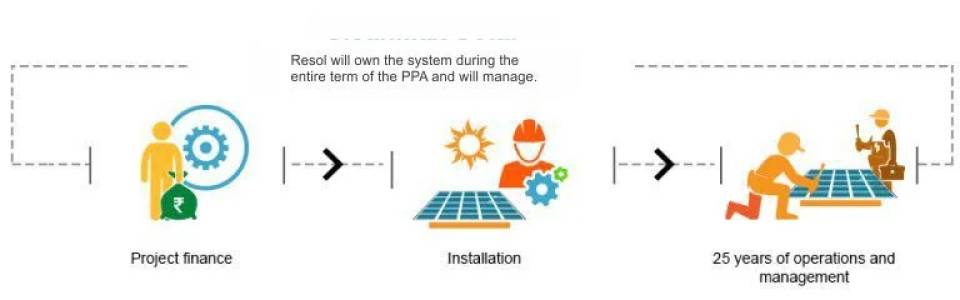

The BOOT (Build-Own-Operate-Transfer) model is a public-private partnership (PPP) framework where a private sector entity designs, builds, owns, and operates an infrastructure project for a predetermined period, after which ownership and operation are transferred to the public sector. This model offers a unique blend of private sector efficiency and public sector ownership, making it suitable for various large-scale infrastructure projects.

Key Features and Benefits:

How it Works:

Suitable Projects:

BOOT projects are particularly well-suited for large-scale infrastructure projects with long operational lifespans, such as:

Potential Challenges:

Conclusion:

The BOOT model presents a viable and attractive option for financing and developing crucial infrastructure projects. However, careful planning, risk assessment, and transparent contract negotiation are paramount to its success. Understanding the specific project requirements, regulatory environment, and potential challenges is critical to determining the suitability of the BOOT model for any given infrastructure project.